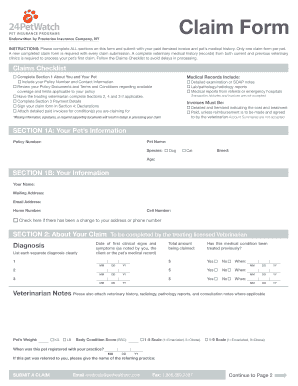

Who needs the Petrarch Claim Form?

Petrarch is a US pet insurance company providing coverage to cats and dogs. If the covered pet is sick or injured, the owner must file the Claim Form in order to receive the reimbursement of the expenses for treatment.

What is the Petrarch Claim form for?

The form must be submitted to record the insured event and to give all important information. Therefore, the owner must fill out the claim form together with the veterinarian in charge.

When is the Pet Insurance Claim form due?

Typically, the owner must submit the filled out form within 90 days after the date of the treatment to be granted the reimbursement.

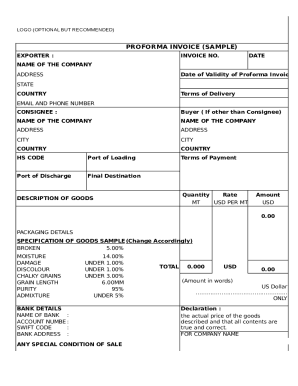

Is the Petrarch Claim Form accompanied by any other forms?

Regardless, of whether the claim is being filed for the first time or not, it is necessary to provide the pet’s complete medical records and all paid veterinary’s itemized invoices for the claimed conditions.

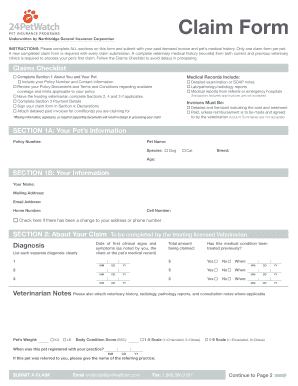

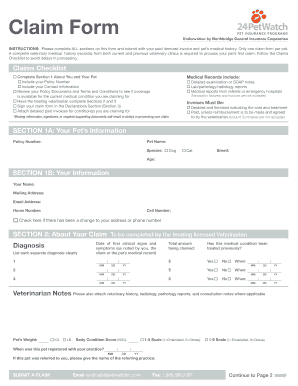

How to fill out the Petrarch Insurance Claim Form?

The form requires providing the following details in part A (filled out by the policyholder):

- Insurance policy number;

- Type of the policy;

- The pet’s owner’s name, address, phone number, email;

- The pet’s name, date of birth, gender, breed;

- Name of the vet or clinic, address and phone number;

- Part B is meant for the vet’s completion:

- Diagnosis or type of illness or injury;

- Date of injury or illness;

- Total cost of the treatment;

- Whether the stated condition has been previously observed;

- Whether ongoing treatment is likely;

- Whether yearly physical examination has been held;

- Referencing clinic (if any);

- Pet’s weight.

- Part C is to provide the details of the pet’s death (if this is the case).

- Part D is the veterinary’s declaration bearing the signature of the attending vet and the clinic’s stamp.

- Part E is the declaration of the authenticity of the provided information by the policyholder.

- They are also required to indicate the amount of claim, sign and date the form.

Where to send the completed Claim Form?

It is to be directed to Pet watch by mail or fax. The details are indicated on the company’s website.